How To Pay Off Debt: A Simple Plan For Any Income

Wondering how to pay off debt on a low income? Or while living paycheck to paycheck? When you organize a simple debt list with a debt payoff plan, it is no longer like a scary pile lurking under the bed. Follow these steps to create an actionable plan with attainable steps to reach your goals, no matter how much (or little) ‘extra’ money you have to work with.

No place for shame in the debt payoff game

Let’s start by setting the tone for approaching our debt. This is a no shame community! If you have a mountain of debt, including debt in default, in collections, and so on, it’s a problem, yes. You need to honor your obligations and you feel trapped by it.

But it is what it is, you’re not alone, and it doesn’t mean anything about the person you are. The bigger the problem, the bigger the challenge, and thus the bigger the victory over debt you will achieve in the end. If you’re feeling totally overwhelmed and not quite ready for laying down your whole plan, just start here to get unstuck instead.

In the process of mastering your money, including managing your debt, you will stretch yourself, challenge yourself, and grow. No shame, no guilt. Just take on the challenge and conquer it. That is my approach and that’s my charge to you now.

Organize your debt info

1. List debts out, add some details

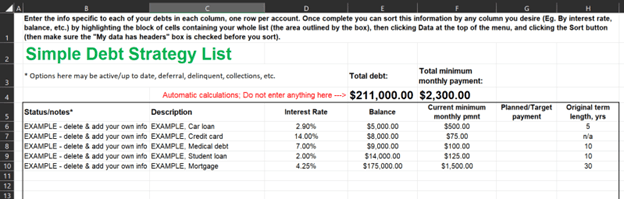

First, you must organize the data on your debts. By data, I mean the balance, interest rate, minimum payment due, etc. The simple debts worksheet I use will get you started quickly. Grab your free copy of my simple debt list spreadsheet for organizing and prioritizing your debt payoff in the form below and be off and running.

With a place ready to organize your info, pull out that debt pile from the denial department of your brain and study each account.

Record the name of the company/creditor/collector (e.g. “Carmax”) with a description of what that debt was for (e.g. “car loan”). Then note the interest rates, the current balances, and the monthly minimum payments (for debts in active payment status).

Eventually as you dig in, also note the term of the loan (5 year, 10 year, etc.) and the year that it would be paid off if you were following the minimum payment plan. Later, you can calculate how much total interest for each one as well (if that gives you extra motivation!). Those details are rewarding to reflect back on when you pay things off early. This info, organized all in one spot, is the basis of your entire debt pay off plan. Simple as that!

2. Double check your credit report

After the accounts you can list relatively quickly, it’s time to visit your credit report to ensure a complete tally of debts attributed to you by the credit bureaus. Go to AnnualCreditReport.com to review your reports from each of the three credit bureaus for free. Each account should be added to your debts worksheet, noting its payment status. Include deferred debt as well, since this should be part of your long term plan.

3. Correct errors

Before going further, verify that each of the accounts from your credit report are correct. There are commonly mistakes on these reports and correcting these errors is the top priority to ensure the data the credit bureaus are keeping on you fairly represents your debts and credit usage. This may involve some phone calls and hunting around, but it is worth taking your time to get a clean slate of information before diving into your payoff plan.

4. Make strategic moves

If you have credit card debt, call the card companies to request a lower interest rate. When you explain you are working on a debt payoff plan and may just switch your card balance elsewhere, they will usually give you a rate reduction. That is a quick and easy thing to get immediate benefit!

If your credit is in good enough shape to open a 0% promotional credit card, you could transfer high interest balances to the promo card (usually for a fee of 3% of the total transferred). Doing this will give you an interest-free balance to attack, getting you debt free faster. Just make sure you pay the entire balance before the 0% period ends! Or else you could end up worse than you started. Don’t do this technique until you are ready to attack that particular credit card balance (see next section on choosing your debt target).

Prioritize your debt payoff

Now that you have an organized spot for your total debt picture, it is time to make a plan for how to payoff that debt for good. It may seem like a daunting list compared to your income and other bills.

But there’s no time limit. It’s about building a prioritized plan, and then zeroing in on just one account at at time. No sense taking up brain space on anything that you can’t change right now. Prioritize so you can keep laser focus on the place you will take action first.

1. Choose your first debt target

The two schools of thought on debt payoff include 1) starting with your lowest balance to see progress the soonest (debt snowball) or 2) starting with your highest interest rate debt to alleviate the costliest debt first (debt avalanche).

To get started, I tend to prefer the first approach (the snowball method) because after picking off even one or two smaller balances relatively quickly, the money that was going towards the first one, can be re-deployed to the second one more quickly. The benefit with this approach is creating quick momentum which continues to build, growing the amount of money you have available for debt attack (hence the “snowball” … rolling down the hill getting bigger… analogy).

For example, if you pay $75 per month for loan with a balance of $3,500 on it, you will free up $75 per month in your cash flow once that debt is gone. When you “snowball” that $75 minimum you had been committed to towards the next debt, you’ve accelerated your debt payoff without even pulling anything additional from your saving or spending money. It’s debt payment that feeds itself.

To me, it’s more psychologically rewarding to start with the smallest account and pay it off fast. Both the snowball and avalanche approach are mathematically solid debt pay down methods. Pick the approach you like best!

2. Attack your debt target like a boss

Now you have a target. One. Single. Target.

Next you will develop a goal for just how much extra money you will dump- every month on autopilot- towards this debt to pay off your debt much quicker than the minimum payment would achieve. This amount is be part of your broader planning process for what you save, spend, and use towards debt.

Once you commit to the amount that you will now put towards debt each month, no matter how small to start, enter your new planned payment for your first targeted debt in your spreadsheet (take that, minimum payment!). Remember, every additional tactic you add to shift money towards debt attack will get you out of debt faster.

Write it, do it, make it automatic.

The rest is just time. Watch your debt balance fall with every monthly chunk you payoff.

Be patient. And be consistent.

If you want to payoff debt on a low income, it is critical to specifically target each “sacrifice” you make and specifically transfer what you would have been spending on something (e.g. cutting cable) directly and automatically each month to your debt target. It’s just about finding places to tweak, even when money is tight, and making those shifts. Lots of little shifts really add up!

3. Re-evaluate, choose next target, rinse, repeat

After your first debt is wiped out, give yourself a big pat on the back. You will feel more confident and now have more money available for faster debt payoff.

You may then choose to switch tactics to that highest interest rate debt (avalanche method), usually credit card debt, once you have some momentum. Or continue your debt snowball to the next highest balance. Think about what fits your psychology because ultimately the best plan is the one that you find motivating and will launch you towards victory.

In your debts list spreadsheet (remember to grab your free simple debt list spreadsheet here), you can highlight the block of data including just the cells containing the header labels (the cells inside the black box) in one big block in order to automatically sort the information within that block. Highlight the block of cells as shown below, and use the ‘Sort’ function under the ‘Data’ tab.

From there, you can choose to sort your block of debts by either balance or interest rate to help prioritize your targets. Highlight that next row (account) that is your new debt target in your favorite ‘Call To Action!’ color. Make the font bold and bigger if you want. Do whatever gets you laser focused to eliminate that line for good ASAP!

No matter the mountain lying under that top target row on your spreadsheet, fixate yourself on this one and only target account.

The process of eliminating debt will take time. And that is ok. Rome wasn’t built in a day. It’s about having an organized debt plan and following through, letting it run its course. It’s not about eliminating the existence of debt in a week…. or even a few years!

But breaking the plan into one debt at a time and solely focusing on that will enable you to keep going, celebrating each victory one at a time as you go.

Baby steps. Target, eliminate, rinse, repeat.

Perspective from the other side

1. It took us 6 years

My own debts list spreadsheet from 8 years ago looks very different than today. It seemed like a lot of owed money at the time and we had very little ‘extra’ income to work with then.

But with steady persistence as a part of our broader money strategy, even with buying another house without selling the first and having two kids in the mean time, we eliminated all non-mortgage debt in 6 years. And we still did DIY home improvements, took little trips, and lived our lives eating more than rice and beans.

You will get there- just get your info together and get started on that first step.

2. Look back on progress & note motivating stats

I like keeping my spreadsheet not only as a planner for what debt to target, but also a record of accomplishments. I actually keep a little list on the bottom of my debts spreadsheet called “Debt Graveyard” where I list the completed balances and what year they were paid off. Whatever keeps you motivated!

Take the time to calculate the amortization schedule and interest you would have paid originally on loans (using free calculators online) and enter that in your worksheet also. Then calculate and enter the total interest paid after your planned extra payment plan. This difference in money you will have saved in interest is highly motivating! And is super rewarding to look back on and realize how much you accomplished by committing to your debt payoff plan.

There are many calculators out there if you just search “loan payoff calculator” – the one at Mint.com is relatively simple and gives you buttons to show the amortization table (where you can view the length of time to full payoff and total interest over the life of the loan, and by month) with and without applying extra payments.

Once you get the hang of these debt payment calculators, they’re quite fun to get you targeted on your goals. For whatever loan I’m focusing on, I like to copy and paste these amortization tables right into my spreadsheet off to one side, so I can view it over time while I make progress on the payments.

3. Commit to no more debt

Finally, no debt repayment plan is complete without committing to no longer accumulating debt! Our culture is precariously addicted to a lifecourse of debt that will exacerbate itself across generations. You must live within your means and ultimately learn to spend less than your means. This path will lead to you financial security and, ultimately, freedom.

Specifically, use credit cards as savvy tools. Do not use credit cards to buy more than you have money for. Period.

Topics here continually come back to the mindset of embracing frugality. To me, being frugal is not to feel or act poor, but to be intentional. It is to live a life fulfilled by what is important to you, not money and stuff. It’s about eliminating the debt you have now, and never having to dig out again.

Join the newsletter

Thanks for reading! You can get more financial wisdom each Thursday in my popular Under 2 email newsletter – short insights to empower your money life – that you can read in 2 minutes or less.

Enter your email now and join 8,000+ other subscribers: